Some Known Questions About Simply Solar Illinois.

Some Known Questions About Simply Solar Illinois.

Blog Article

How Simply Solar Illinois can Save You Time, Stress, and Money.

Table of Contents10 Easy Facts About Simply Solar Illinois ShownLittle Known Facts About Simply Solar Illinois.Our Simply Solar Illinois StatementsWhat Does Simply Solar Illinois Mean?Rumored Buzz on Simply Solar Illinois

Our group partners with local areas throughout the Northeast and past to provide clean, affordable and reliable power to promote healthy communities and maintain the lights on. A solar or storage space job delivers a number of advantages to the neighborhood it serves. As technology developments and the price of solar and storage decline, the financial advantages of going solar remain to increase.Support for pollinator-friendly environment Environment repair on polluted websites like brownfields and land fills Much needed color for animals like sheep and fowl "Land financial" for future agricultural usage and dirt high quality improvements As a result of environment change, severe weather is coming to be more constant and disruptive. Because of this, home owners, services, neighborhoods, and utilities are all becoming increasingly more thinking about securing power supply services that offer resiliency and power security.

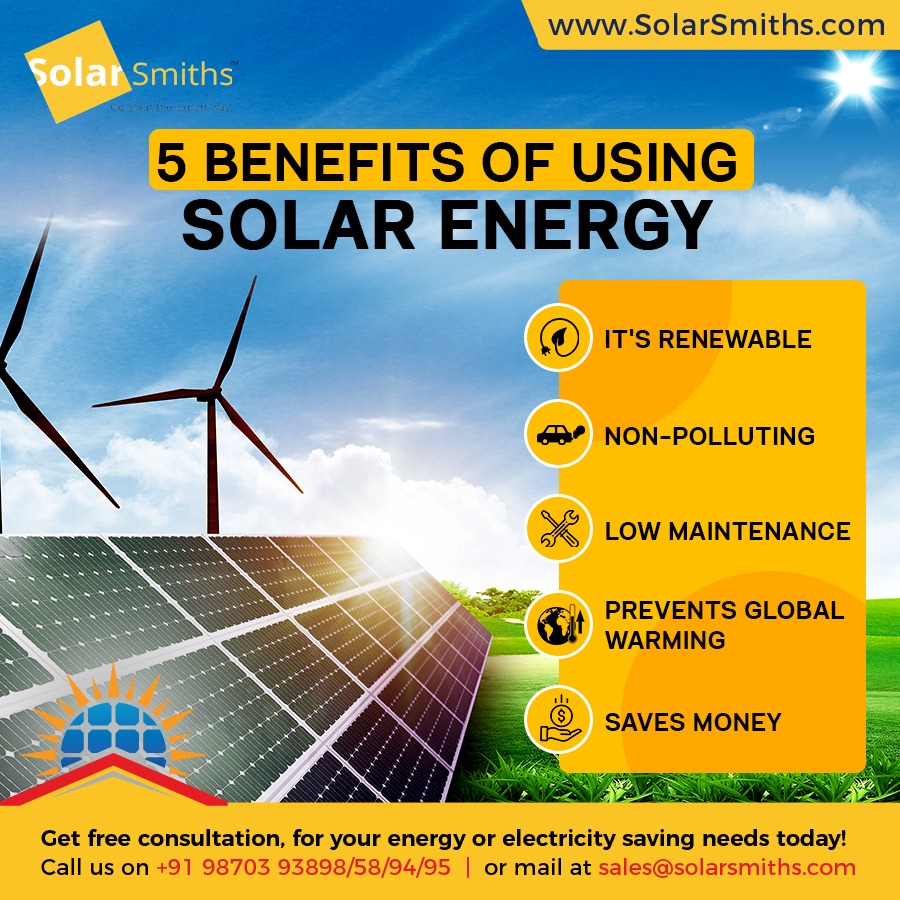

Ecological sustainability is an additional key driver for companies purchasing solar energy. Numerous business have robust sustainability goals that include reducing greenhouse gas discharges and making use of much less sources to aid decrease their influence on the natural surroundings. There is an expanding necessity to attend to environment modification and the pressure from customers, is reaching the top levels of companies.

An Unbiased View of Simply Solar Illinois

As we come close to 2025, the integration of photovoltaic panels in industrial projects is no much longer just an alternative but a strategic need. This blogpost explores exactly how solar power works and the multifaceted advantages it brings to industrial buildings. Photovoltaic panel have actually been utilized on property buildings for years, however it's just lately that they're becoming extra typical in business building.

In this post we talk about exactly how solar panels work and the advantages of using solar energy in industrial buildings. Electricity prices in the U.S. are increasing, making it extra pricey for companies to operate and extra tough to plan ahead.

The U - Simply Solar Illinois.S. Power Info Administration anticipates electrical generation from solar to be the leading resource of growth in the U.S. power sector with completion of 2025, with 79 GW of new solar capacity predicted to find online over the next two years. In the EIA's Short-Term Energy Overview, the agency stated it anticipates renewable power's total share of electricity generation to increase to 26% by the end of 2025

Simply Solar Illinois Fundamentals Explained

The sunlight triggers the silicon cell electrons to propel, creating an electrical existing. The photovoltaic or pv solar battery soaks up solar radiation. When the silicon communicates with the sunlight rays, the electrons start to move and produce a flow of straight go now electric current (DC). The cables feed this DC electrical energy into the solar inverter and convert it to rotating power (A/C).

There are a number of ways to save solar power: When solar power is fed right into an electrochemical battery, the chain reaction on the battery parts maintains the solar power. In a reverse response, the present departures from the battery storage for intake. Thermal storage space makes use of tools such as molten salt or water to keep and absorb the heat from the sun.

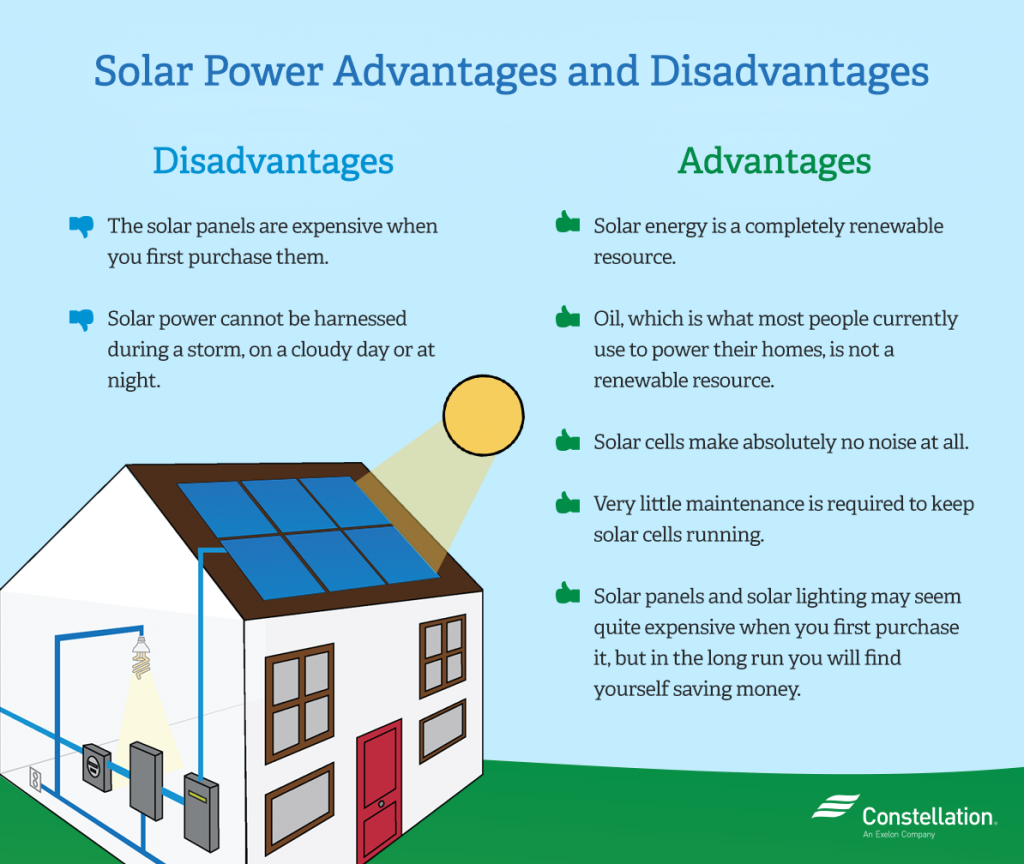

Solar panels substantially decrease power costs. While the initial investment can be high, overtime the expense of setting up solar panels is recovered by the money saved on power expenses.

Everything about Simply Solar Illinois

By setting up photovoltaic panels, a brand name shows that it respects the atmosphere and is making an initiative to click to read lower its carbon impact. Structures that rely entirely on electric grids are prone to power blackouts that occur throughout poor climate or electric system breakdowns. Solar panels installed with battery systems allow business buildings to continue to work during power interruptions.

Simply Solar Illinois Things To Know Before You Get This

Solar power is one of the cleanest types of power. With resilient warranties and a manufacturing life of up to 40-50 years, solar financial investments contribute dramatically to environmental sustainability. This shift in the direction of cleaner energy sources can result in more comprehensive economic benefits, consisting of lowered climate modification and environmental degradation expenses. In 2024, house owners can gain from federal solar tax motivations, permitting them to counter almost one-third of the acquisition rate of a planetary system through a 30% tax credit.

Report this page